Is Equity Release a Good Idea? The Pros and Cons Explained

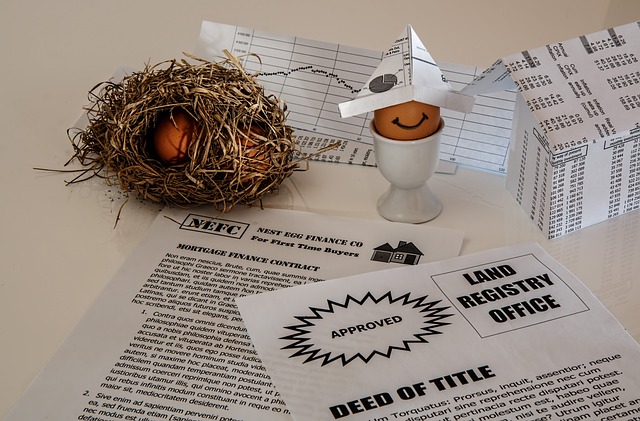

Equity release allows homeowners in the United Kingdom, typically aged 55 or over, to unlock tax-free cash from the value of their property while retaining the right to live in it. This financial product can provide a significant lump sum or a regular income, offering a potential solution for those seeking to boost their retirement funds, pay off existing debts, or help family members financially. Understanding its mechanisms and implications is crucial for making an informed decision about whether it aligns with your long-term financial goals and circumstances.

For many UK homeowners, the family home is their biggest asset, yet much of that value is tied up in bricks and mortar. Equity release is one way to access some of that wealth later in life, typically without making monthly repayments. Whether it is sensible depends on your goals, your alternatives, and how comfortable you are with long-term trade-offs.

Is equity release a good idea?

Equity release is an umbrella term, but in practice it usually means a lifetime mortgage: you borrow against your home, retain ownership, and the loan plus interest is normally repaid when you die or move into long-term care. The main advantages are improved cash flow and flexibility (some plans allow drawdown rather than a lump sum). The main downsides are compound interest (the balance can grow quickly), potential early repayment charges, and reduced options later (for example, moving may be harder depending on portability rules). It can be a good fit when you need stable access to cash and expect to stay in your home long term, but it is rarely a “set and forget” decision.

Does equity release affect your inheritance?

In most cases, yes. Because interest usually rolls up, the amount repaid from your estate can be significantly higher than the amount you initially borrowed. That typically reduces the value left to beneficiaries, and the impact is greater the longer the plan runs. Some products offer inheritance protection features, but choosing them can reduce the amount you can borrow. It is also worth considering how equity release interacts with gifting: gifting released cash may have inheritance tax implications under standard UK rules, and it can affect means-tested benefits if the release increases savings or if gifting is treated as deprivation of assets.

Lifetime mortgage vs downsizing: key differences

A lifetime mortgage keeps you in your home and avoids the practical disruption of moving, but you pay for that convenience through interest and fees over time. Downsizing converts property value into cash by selling and buying a cheaper home; it has upfront transaction costs and depends on the local housing market, but it avoids the compounding effect of interest. In real life, the choice often comes down to priorities: staying put, access to local support networks, adapting the current home, or whether a smaller property would be more practical.

Another practical difference is flexibility. A downsizer can choose exactly how much to release by selecting a purchase price, while equity release is limited by age, property value, health criteria (for enhanced plans), and lender loan-to-value rules. If you may need to move later, check how “portability” works on any lifetime mortgage, and whether the new property would meet the lender’s criteria.

Real-world cost and pricing insight matters because the largest “cost” is usually rolled-up interest, which compounds over time. In addition, there can be arrangement fees, valuation fees, and legal costs, plus potential early repayment charges if you repay sooner than expected. Typical lifetime mortgage interest rates in the UK often sit in the mid- to high-single digits (AER) depending on the product and borrower profile, but the only reliable figure is a personalised quote at the time you apply.

| Product/Service | Provider | Cost Estimation |

|---|---|---|

| Lifetime mortgage (fixed rate) | Aviva | Interest rate varies by quote; fees may include advice, valuation, and legal costs |

| Lifetime mortgage (fixed rate) | Legal & General | Interest rate varies by quote; may offer drawdown options; fees depend on channel and case |

| Lifetime mortgage | Canada Life | Interest rate varies by quote; product fees and early repayment charges may apply |

| Lifetime mortgage | LV= | Interest rate varies by quote; fees depend on product and advice route |

| Lifetime mortgage | more2life | Interest rate varies by quote; may support enhanced terms for some applicants |

| Home sale transaction (downsizing) | Local estate agents | Estate agent fees often around 1%–3% + VAT of sale price (varies by contract and area) |

| Conveyancing (sale and purchase) | UK solicitors/conveyancers | Commonly hundreds to a few thousand pounds total, depending on complexity |

| Stamp Duty Land Tax (on purchase) | HMRC | Depends on purchase price and buyer circumstances; can be £0 or substantially more |

| Removal and moving costs | Removal firms | Often a few hundred to a few thousand pounds depending on distance and volume |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

No negative equity guarantee: how it works

Many UK plans that follow Equity Release Council standards include a no negative equity guarantee. In plain terms, if your home is sold after death or moving into long-term care and the sale proceeds are not enough to repay the loan, neither you nor your estate should owe more than the sale value, provided the property is sold for a reasonable market price. This is designed to protect families from a debt being passed on. It does not, however, prevent the remaining equity from shrinking; it simply limits the downside so the debt does not exceed the property value.

How much cash can you release tax-free?

Money released from a lifetime mortgage is generally a loan rather than income, so it is not usually subject to income tax. The amount you can access depends mainly on your age and property value (and sometimes health, for enhanced terms). Some products allow a smaller initial amount with a reserve you draw later, which can reduce interest growth compared with taking a full lump sum on day one. Even if the cash is not taxed as income, it can affect other parts of your finances: it may change eligibility for means-tested benefits, and if you gift the money, there may be inheritance tax considerations depending on timing and circumstances.

Equity release can solve specific retirement funding problems, particularly when moving is impractical and income is limited. The trade-off is long-term cost, less flexibility later, and a likely reduction in inheritance. A balanced decision usually comes from comparing it with alternatives such as downsizing, using savings, or adjusting spending, and from focusing on how long you expect to stay in your home and how important leaving equity behind is to you.