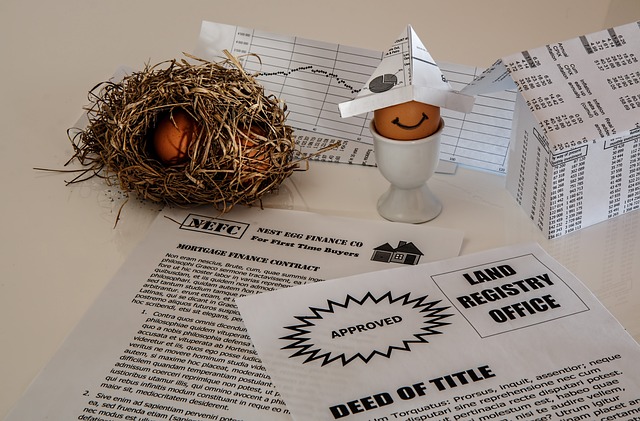

Everything You Need to Know About Foreclosed Homes: Options and Costs

Foreclosed homes present a unique opportunity in the real estate market, often available at attractive prices. These properties have been repossessed by financial institutions due to mortgage payment defaults. However, buying a foreclosed home requires careful evaluation of potential risks and benefits, including property condition and legal considerations. Understanding the process and comparing costs can help buyers make informed decisions in this niche market.

Foreclosed properties represent a significant segment of the real estate market, offering both opportunities and challenges for potential buyers. When homeowners default on their mortgage payments, lenders initiate foreclosure proceedings to recover their investment, ultimately leading to properties being sold through various channels. The foreclosure market encompasses different types of properties and purchasing methods, each with unique characteristics that buyers should understand before making investment decisions.

How Much Does a Foreclosed Home Cost and What Factors Influence the Price?

The cost of foreclosed homes varies significantly based on multiple factors including location, property condition, market demand, and the specific foreclosure stage. Generally, foreclosed properties sell for 10-30% below market value, though this discount reflects the property’s condition and the expedited sale process. Key pricing factors include the outstanding mortgage balance, accumulated fees, property taxes owed, and repair costs needed to bring the home to market standards.

Location remains the primary price determinant, with urban markets typically commanding higher prices even in foreclosure. Property condition significantly impacts value, as many foreclosed homes require substantial repairs due to deferred maintenance or damage from vacant periods. Market competition also influences pricing, with desirable areas seeing multiple bidders driving prices closer to market rates.

Foreclosed Homes: Discover the Main Options Available

Three primary foreclosure purchasing options exist: pre-foreclosure sales, auction purchases, and bank-owned property acquisitions. Pre-foreclosure involves buying directly from homeowners facing foreclosure, often through short sales where lenders accept less than the mortgage balance. This option requires patience and negotiation skills but may offer the best deals.

Foreclosure auctions provide immediate ownership transfer but require cash payments and offer no inspection opportunities. Buyers must research properties thoroughly beforehand and understand that purchases are final regardless of discovered issues. Bank-owned properties, also called Real Estate Owned (REO) properties, represent the most straightforward option, allowing inspections and traditional financing while offering clear titles.

Explanation of Bank-Owned Properties and the Purchasing Process

Bank-owned properties result when foreclosure auctions fail to attract buyers meeting minimum bid requirements. Banks then assume ownership and typically hire real estate agents to market these properties through Multiple Listing Service (MLS) platforms. This process resembles traditional home purchases but with specific considerations unique to bank ownership.

The purchasing process begins with property identification through MLS searches or bank websites. Buyers submit offers through listing agents, with banks often requiring proof of financing or cash availability. Banks typically provide property disclosures but may offer limited warranties, selling properties “as-is” without guarantees regarding condition or repairs. Closing processes follow standard procedures, though banks may require specific contract terms or extended closing periods.

Important Risks and Considerations Before Buying

Foreclosed property purchases carry inherent risks requiring careful evaluation. Property condition represents the primary concern, as many foreclosed homes suffer from deferred maintenance, vandalism, or weather damage during vacancy periods. Buyers should budget for extensive repairs, including potential structural, electrical, or plumbing issues not immediately apparent during initial inspections.

Title complications may arise from unpaid taxes, liens, or legal disputes requiring resolution before clear ownership transfer. Some foreclosed properties face code violations or permit issues that new owners must address. Additionally, neighborhood conditions may have deteriorated due to multiple foreclosures, potentially affecting long-term property values and resale prospects.

Comparison of Costs and Providers in the Foreclosure Market

Understanding cost structures across different foreclosure purchasing methods helps buyers select appropriate strategies. Various service providers facilitate foreclosure purchases, each offering distinct advantages and fee structures.

| Service Type | Provider Examples | Cost Range | Key Features |

|---|---|---|---|

| Foreclosure Listing Services | RealtyTrac, Foreclosure.com | $30-100/month | Property databases, auction schedules |

| Real Estate Agents | Coldwell Banker, RE/MAX | 3-6% commission | MLS access, negotiation support |

| Auction Companies | Auction.com, Hudson & Marshall | 5-10% buyer premium | Live and online auctions |

| Title Companies | First American, Chicago Title | $500-2000 | Title searches, insurance |

| Home Inspectors | Local certified inspectors | $300-800 | Property condition assessments |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

Additional costs include financing fees, which may be higher for foreclosed properties due to perceived risks. Cash buyers avoid financing costs but must consider opportunity costs of tied-up capital. Repair and renovation expenses vary widely, with some properties requiring minimal work while others need complete rehabilitation.

Successful foreclosure investing requires thorough research, realistic budgeting, and patience throughout the purchasing process. While these properties offer potential savings, buyers must carefully evaluate all costs and risks to ensure profitable investments. Working with experienced professionals familiar with foreclosure procedures helps navigate complex transactions and avoid common pitfalls that could result in unexpected expenses or legal complications.